does wyoming charge sales tax

It is also the same if you will use Amazon FBA there. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

Sales Tax For Online Or Remote Vendors A Study In Complexity Wyoming Sbdc Network

This page discusses various sales tax exemptions in Wyoming.

. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Are services subject to sales tax in Wyoming. Supreme Court changed the rules for collecting sales tax by Internet-based retailers stating that individual states can require online sellers to collect state sales tax.

If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Internet sales tax is a tax on Internet-based services.

This page describes the taxability of services in Wyoming including janitorial services and transportation services. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The remaining nine states are those that dont levy a state tax at all.

See the publications section for more information. This page describes the taxability of food and meals in Wyoming including catering and grocery food. For example Juneau Borough charges a 5 sales tax on eligible purchases and it collected over 47 million in.

The state sales tax rate in Wyoming is 4. Wyomings tax on a room can and has reached the 10 mark in some communitiesResearch shows total room taxes above 10 discourage extra traveler spendingLodging businesses in Wyoming are assessed the county sales taxes PLUS any. Wyoming is a destination-based sales tax state.

However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. The states with the lowest combined state and local sales tax rates are Hawaii Wyoming Wisconsin and Maine. To learn more see a full list of taxable and tax-exempt items in Wyoming.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. Tax rate charts are only updated as changes in rates occur. So if you live in Wyoming collecting sales tax is not very easy.

In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. But understanding the complexities surrounding Wyoming real estate tax laws can be overwhelming.

While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. Wyoming And then theres California. This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not.

There are currently five states that have no sales tax at all Alaska Delaware Montana New Hampshire and Oregon. Wyoming is known for its real estate tax benefits. Several other states such as Delaware South Dakota and Washington tax some services.

For many years states argued that they were losing money by not collecting sales tax on Internet sales. Email dorwyogov Back to Divisions. This state has a modified origin system in place in which state county and city taxes are origin-based but district transaction taxes are destination-based.

To learn more see a full list of taxable and tax-exempt items in Wyoming. We include these in their state sales. On June 21 2018 the US.

In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The state prides itself on being a place where people that fosters real estate transactions. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

Throughout Alaska many of their counties known as boroughs do charge sales tax. Does Wyoming charge sales tax on vehicles. We advise you to check out the Wyoming Department of Revenue Tax Rate for 2020 PDF which has the current rates.

Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. 3 Remote Internet Sellers. Sales Use Tax Rate Charts Please note.

An example of taxed services would be one which sells repairs alters or improves tangible physical property. Handling Wyoming Shipping and Handling Sales Tax with TaxJar The TaxJar app defaults to the most common Wyoming scenario that shipping and handling is non-taxable. Shipping and handling charges are generally exempt in Wyoming when separately stated and distinguishable from any taxable charge that may appear on the same invoice.

Wyoming Shipping Taxability Summary As a seller you will not have to charge sales tax on shipping and handling in Wyoming if those charges are listed separately on the invoice. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Have a question or comment.

B Three states levy mandatory statewide local add-on sales taxes. Effective October 1 2019 sales of digital goods which includes audio works visual works audio-visual works reading materials or ring tones which are electronically accessed or transferred will be subject to sales and use taxes at the standard 635 rate. State wide sales tax is 4.

California 1 Utah 125 and Virginia 1. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs alterations or improvements to tangible personal property in the scope of those services. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

You must collect sales tax at the tax rate where the item is being delivered. However when part of the sale price of a taxable sale the charges are generally taxable. This is the same whether you live in Wyoming or not.

It has low sales and property taxes and theres no estate tax capital gains tax or state income tax. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Alabama and Hawaii also.

Sales Tax Exemptions in Wyoming.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

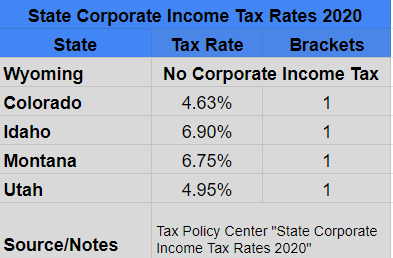

Wyoming Wy State Income Tax Information

Should You Be Charging Sales Tax On Your Online Store Sales Tax Filing Taxes Sale

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Is Shipping Taxable In Wyoming Taxjar Blog

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Sales Tax Small Business Guide Truic